Retirement

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

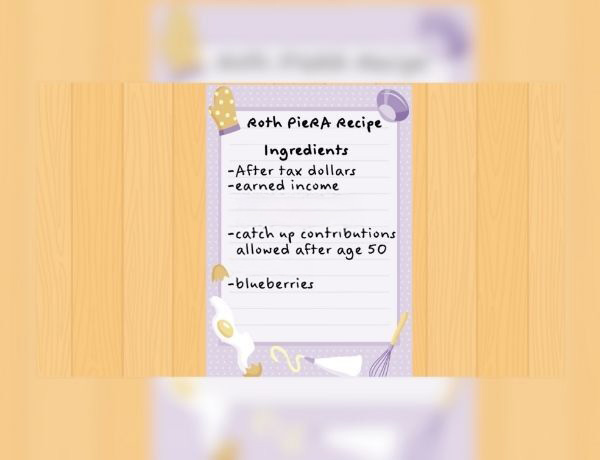

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Have A Question About This Topic?

Should You Tap Retirement Savings to Fund College?

There are three things to consider before dipping into retirement savings to pay for college.

Healthcare Costs in Retirement

Without a solid approach, healthcare expenses may add up quickly and potentially alter your spending.

A Fruitful Retirement: Social Security Benefit

Taking your Social Security benefits at the right time may help maximize your benefit.

Important Birthdays Over 50

Here's a look at several birthdays and “half-birthdays” that have implications regarding your retirement income.

How Retirement Spending Changes With Time

It can be difficult for clients to imagine how much they’ll spend in retirement. This short, insightful article is useful.

Split Annuity Strategy

Here's one strategy that combines two different annuities to generate income and rebuild principal.

Traditional vs. Roth IRA

One or the other? Perhaps both traditional and Roth IRAs can play a part in your retirement plans.

Six Surprising Facts About Retirement Confidence

This attention-grabbing infographic covers retirement topics you may not have considered.

How the SECURE Act 2.0 Changed RMDs

Understand how SECURE Act 2.0 affects RMDs and how using a QCD can possibly benefit both taxes and charitable goals.

View all articles

Saving for Retirement

This calculator can help you estimate how much you may need to save for retirement.

Annuity Comparison

This calculator compares a hypothetical fixed annuity with an account where the interest is taxed each year.

Self-Employed Retirement Plans

Estimate the maximum contribution amount for a Self-Employed 401(k), SIMPLE IRA, or SEP.

Inflation & Retirement

Estimate how much income may be needed at retirement to maintain your standard of living.

Estimate Your RMD

Help determine the required minimum distribution from an IRA or other qualified retirement plan.

A Look at Systematic Withdrawals

This calculator may help you estimate how long funds may last given regular withdrawals.

View all calculators

Working With A Financial Professional

A financial professional is an invaluable resource to help you untangle the complexities of whatever life throws at you.

A Bucket Plan to Go with Your Bucket List

A bucket plan can help you be better prepared for a comfortable retirement.

The Power of Tax-Deferred Growth

Why are 401(k) plans, annuities, and IRAs so popular?

Should You Ever Retire?

A growing number of Americans are pushing back the age at which they plan to retire. Or deciding not to retire at all.

RE: Retirement

How does your ideal retirement differ from reality, and what can we do to better align the two?

Risk Tolerance: What’s Your Style?

Learn about what risk tolerance really means in this helpful and insightful video.