Getting reliable oil data on any country outside the United States is very nearly an exercise in futility. Even a country with "good" data like the United States sources that data from a half dozen separate bureaus and 50 different states which tend to generate their data either by county or company or a hybridization of both. Muddled data and miscounts are more the norm than accurate collection.

Moreover, any firm that is not publicly traded tends to consider production and sales data a corporate secret, while most countries consider such information flat out state secrets. This proves doubly true for information relating to storage. After all, the core rationale of state-operated oil storage facilities is to enable a country to outlast a crisis like a war.

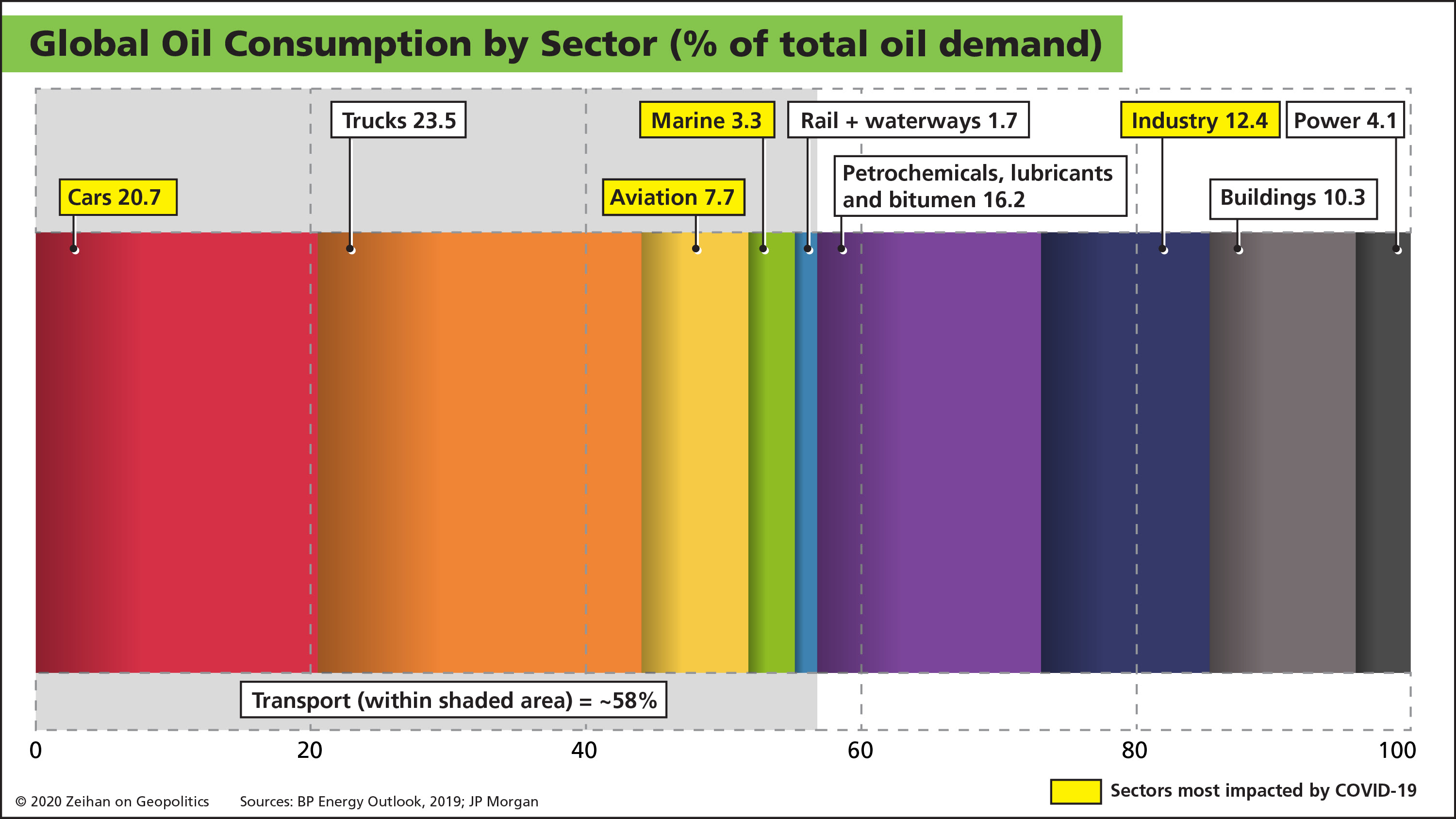

The result is that we only have decent data at the very low end (when looking at a specific firm or field) or at the very high end (when we're evaluating something global in scope). Today's graphic looks at the high: total oil demand broken down by major usage.

There's a few nuggets to tease out, both about the coronavirus crisis and the future of the sector in general.

First, coronavirus has kept much of the world's population cooped up, especially in the more energy-intensive developing and developed economies. That's hit both energy demand for personal use, as well as in industries that support private consumption. Cars, aviation, marine transport and industry have all seen massive drops in oil demand, that at the trough collectively added up to nearly one-fifth of total global demand. (This, of course, is a best guess – remember, the data isn't great.)

While all these categories have experienced significant rebounds as parts of the world have reopened, they are nowhere near pre-COVID levels.

Even in places with low virus levels, people remain skittish and have cut back their activities.

The pandemic is hardly over. Globally we have far more cases now than two months ago, with the bulk of the (non-China) developing world only now starting its epidemic.

The United States – the world's largest oil consumer – has backslid and is likely to experience an extended period of subpar economic activity.

Europe and East Asia may be mostly virus free, but their rapidly aging demographics means they are more suppliers than consumers. Full recovery there first requires full recovery in the more consumption-driven United States and (non-China) developing world.

Collectively, these categories comprise 45% of "normal" oil demand. All of them will remain depressed for at least the rest of 2020. In the case of the aviation category, don't expect a meaningful recovery until after 2023.

Second, one surprisingly resilient category has been trucking, a sector whose oil demand is linked to both local goods distribution and long-haul transport. Oil demand for this sector has proven stubbornly resilient for the simple reason that goods don't magically transport themselves from farms or ports to people. Trucking is how most people get their stuff, whether that stuff is delivered to stores or their homes. If this sector's oil demand drops, it means economic catastrophe is in full swing. It has not. So far, so good.

Finally, I'd like to highlight a category for you Greens out there: buildings.

Greens the world over have a reputation for going for big, splashy, high-tech, high-dollar, PR-friendly topics: Electronic vehicles, fields of solar panels, forests of wind turbines. That's all well and good, but some 10% of global oil supply is burned in boilers to make heat and power for buildings. It is wildly inefficient, wildly expensive and not particularly safe. Better, cleaner, cheaper and safer methods of delivering heat and power have existed for decades. Updating the internal infrastructure of buildings block-by-block has so far been perceived by the Green community as insufficiently macro or sexy to pursue, yet addressing the boiler problem is the ultimate low-hanging fruit in any deep decarbonization effort. Food for thought.

These topics are just the proverbial iceberg-tip. Global energy patterns are spasming in the wake of the COVID crisis, and now that the initial shock is past we're able to tease out several trends that will shape global oil for years to come. Shifts in blending patterns and trade flows. Major producers simply collapsing, never to return. And of course, the Russians are being sneaky.